Pre tax contribution calculator

The second is a fixed rate of 2 of every employees compensation regardless of whether they participate. Ad Our Resources Can Help You Decide Between Taxable Vs.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Salary Your annual gross salary.

. Contributions to workplace plans typically go in on a pre-tax basis which means the employer puts it into the account before including it with taxable income. Any contribution made to a designated pension plan retirement account or other tax deferred investment vehicle where the contribution is made. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Superannuation guarantee contributions are payable. Using the calculator In the following boxes youll need to enter. Get your BPAY number.

By making pre-tax contributions you are lowering your current taxable income. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. After age 59 12 contributions.

A 401 k Contribution calculator will help one to calculate the contribution that will be made by the individual and the employer contribution as well depending upon the limits. Visit the Social Security please visit the Social Security Calculator smaller taxable income by the Internal Service. The amount you will contribute to a 457 each year.

The annual maximum for 2022 is 20500. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Your expected annual pay increases if any.

The first is a match of employees contributions up to 3 of their compensation. Make post-tax contributions to your super via cheque complete a Member and Spouse Contribution form. Pre-tax Calculator A 457 plan contribution can be an effective retirement tool.

For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when the money is. If you are age 50 or over. Limit helps reduce your tax liability are.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. The Roth 457 plan allows you to contribute to your 457 account on an after-tax basis. When you make a pre-tax contribution to your.

This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month. For example if you earn 10000 per month and contribute 10 of it towards a 401k retirement savings. The purpose of the Retirement Contribution Effects on Your Paycheck is to illustrate how increasing contribution amounts to 401 ks 403 bs andor.

How frequently you are paid by your. Make post-tax contributions via BPAY. Division 293 tax for high-income earners.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Thats where our paycheck calculator comes in. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

The calculator only considers a limited range of issues and does not consider all of your personal circumstances financial goals or needs. Division 293 tax is an additional tax on super contributions if your combined income and super contributions are more than the threshold.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Solo 401k Contribution Limits And Types

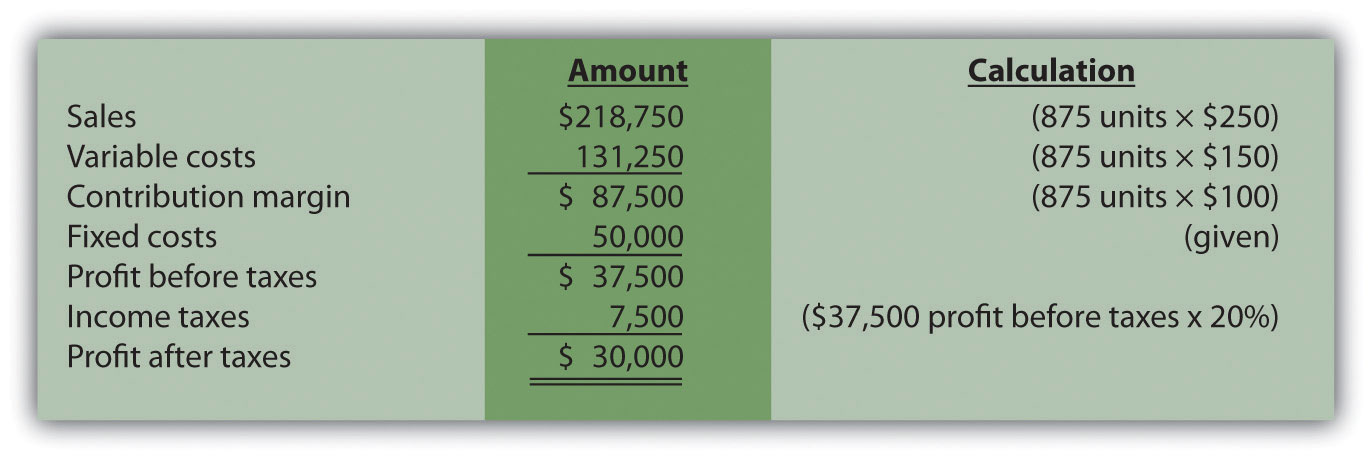

Income Taxes And Cost Volume Profit Analysis

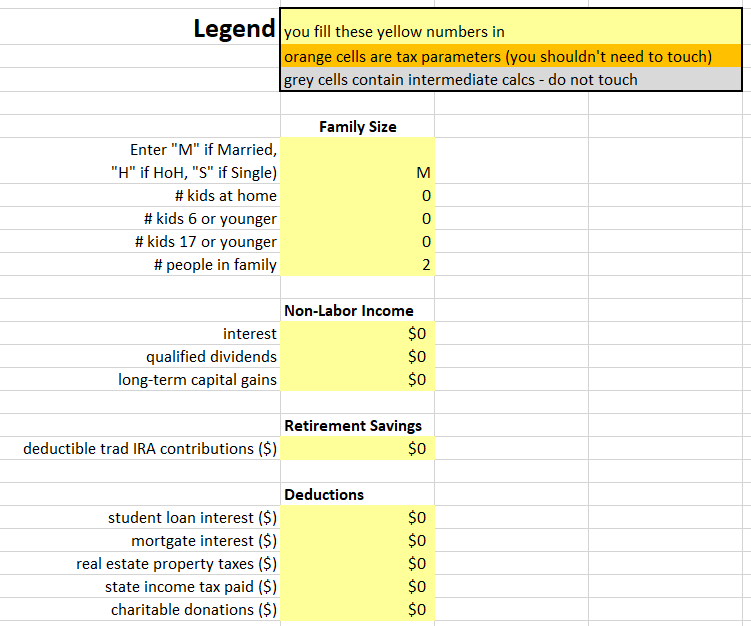

2021 Tax Calculator Frugal Professor

Pre Tax Profit Margin Formula And Ratio Calculator Excel Template

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

After Tax Contributions 2021 Blakely Walters

Roth Ira Calculator Roth Ira Contribution

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Income Tax Calculator Estimate Your Refund In Seconds For Free

Traditional Vs Roth Ira Calculator

Pre Tax Income Ebt Formula And Calculator Excel Template

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement